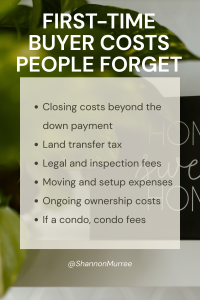

First-Time Buyer Costs People Forget in Simcoe County

1. Closing costs beyond the down payment

Your down payment is not the same thing as your closing costs.

In Simcoe County, closing costs are paid around the time your purchase completes and typically include legal fees, disbursements, adjustments, and required registrations. A common rule of thumb is to budget 1.5% to 4% of the purchase price, depending on the property type and location.

Many first-time buyers underestimate this category because it isn’t always discussed upfront. Planning for it early helps avoid last-minute scrambling.

2. Land transfer tax in Ontario

Land transfer tax is one of the most frequently overlooked costs.

Buyers in Simcoe County pay the Ontario land transfer tax. Unlike Toronto, there is no additional municipal land transfer tax, which can make ownership more attainable for first-time buyers compared to the GTA.

First-time buyer rebates may apply, but they do not always eliminate the tax entirely. The exact amount depends on purchase price and eligibility.

3. Legal and inspection fees

Legal fees are required to complete the transaction properly and protect your interests as a buyer. These typically include the lawyer’s fee plus disbursements such as title searches and registrations.

Home inspections are especially important in Simcoe County, where housing stock ranges from newer subdivisions to older homes, rural properties, and waterfront residences. An inspection helps identify potential issues before finalising the purchase.

4. Moving and setup expenses

Moving costs add up quickly and are often forgotten.

This category can include:

- Movers or truck rentals

- Packing supplies

- Utility hookups and deposits

- Internet and cable installation

- Immediate purchases such as window coverings, tools, or minor repairs

Buyers relocating within Simcoe County or moving from the GTA are often surprised by how much this transition phase costs.

5. Ongoing ownership costs

Owning a home comes with ongoing expenses that differ from renting.

In Simcoe County, these may include:

- Property taxes, which vary by municipality

- Home insurance, particularly for rural or waterfront properties

- Utilities such as heating, water, and electricity

- Maintenance, snow removal, and seasonal upkeep

- Condo fees, if applicable

These costs affect monthly affordability and long-term comfort far more than the purchase itself.

Why planning ahead matters in Simcoe County

Simcoe County offers a wide range of housing options, from urban neighbourhoods to rural properties and waterfront communities. That diversity means costs can vary significantly from one purchase to the next.

Understanding the full financial picture helps first-time buyers make informed decisions that align with both their budget and lifestyle.

Final thoughts

Buying your first home is one of the biggest financial decisions you’ll make. The more transparent the process feels, the more confident you become.

If you’re early in your planning or trying to understand what a realistic budget looks like beyond the down payment, grounding yourself in the full cost picture is one of the smartest first steps you can take.

Clear context leads to better decisions.

Also check out our buying vs renting blog or our listings if you haven’t purchased yet